IN TODAY’S REPORT

What we cover: Buying October 1 examined. Bitcoin stats. The Halving Year ratios.

TODAY’S STATS

A New Look At “Uptober”

Much of Crypto Twitter aka Crypto X proclaims the month of October as “Uptober.” Today —in our own way — we put that notion to the test.

What if you bought Bitcoin on October 1st — every single year — and held it for one year? Before you shout that you’d never do something so pointless as to buy an asset on October 1st, hold it for one day less than a full year selling it on September 30th, then buy it right back again the next day on the subsequent October 1st, hear us out.

We’re not constructing a trading strategy, only looking to see if there’s a meaningful seasonal tendency for Bitcoin.

While we’ve basically already stated them, let’s define the conditions. Our simple query conditions below:

//QUERY CONDITIONS//

ENTRY CONDITION: Buy on October 1st at the open of the daily candle

EXIT CONDITION: Exit ("sell") just under one year later on September 30thLet’s begin with Bitcoin’s hypothetical trade results, starting with October 1, 2011. Note that the first data point below shows “2012”, not “2011.” This is correct because it reflects the exit date not the entry. The first exit date for the test would therefore be September 30th, 2012, the last day of Q3.

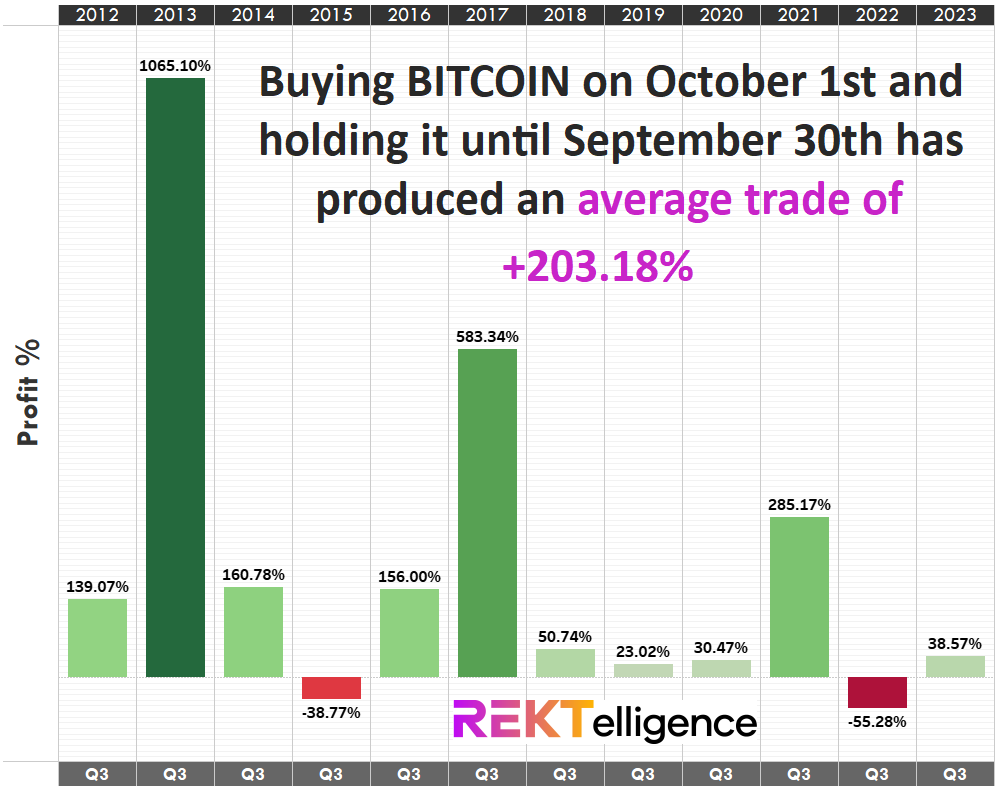

BITCOIN (BTC/USD). “Buy October” with a 1-Year Hold Time. 2011-Now.

With only two negative results since 2011, an October entry into Bitcoin looks promising at first glance.

Best Result: +1065.10%

Worst Result: -55.28%

Average Result: +203.18%

The Bitcoin literate will immediately notice that the stand-out results follow the Bitcoin block reward halving which occurs approximately every four years. The “Buy October 1st” in past halving years are impressive:

2012 (Halving Year) to 2013: +1065.10%

2016 (Halving Year) to 2017: +583.34%

2020 (Halving Year) to 2021: +285.17%

2024 (Halving Year) to 2025: To Be Determined

While returns have diminished in subsequent halving-year trades, the ratios are interestingly similar, with an average of 1.935.

Ratio of 2013 Result to 2017 Result: 1.825

Ratio of 2017 Result to 2021 Result: 2.045

Were this characteristic to persist, we might see something like this in 2025:

2024 (Halving Year) to 2025: +147.3%

Naturally — in 2023 — there are more variables to consider than ever before. The Regulation factor. The Spot ETF(s) factor. The BRICs factor. The Futures Markets growth factor. This is just the start.

We’ll examine the same “Buy October” hypothetical for Ethereum later this week.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC