IN TODAY’S REPORT

What we cover: Bitcoin’s 6-month range. The REKTelligence VOLticipation Ultra indicator at extreme. Parallels to a 41x move.

TODAY’S TECHNICAL VIEW

Revisiting 2016

No one’s talking about it, but the parallels to 2016 are growing.

Not only is Bitcoin stuck in a 6-month range under 25% from top to bottom, a technical state which has only occurred once before in 2016 (see last week’s “Does 2016 Suggest Bitcoin 89,197?”), but we’re now seeing another extreme reading emerge over the past week for the king crypto.

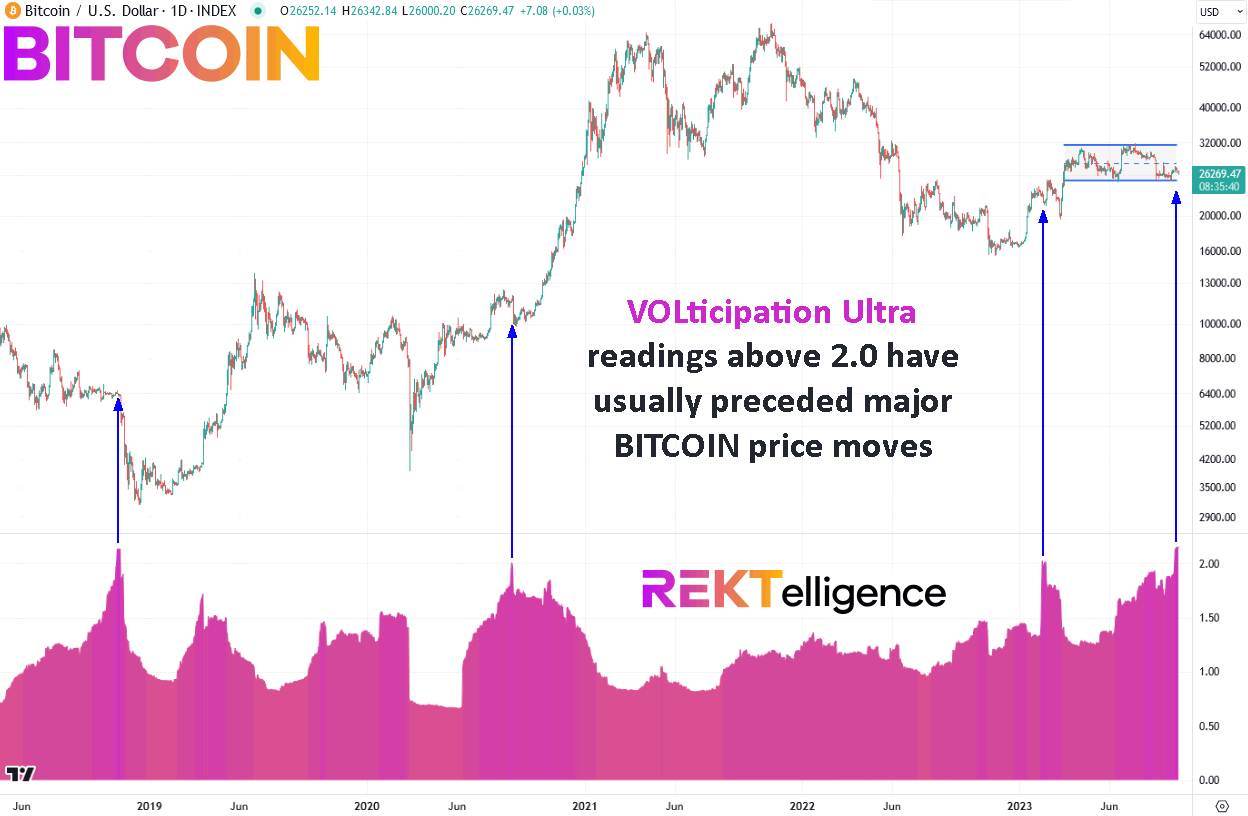

The REKTelligence VOLticipation Ultra indicator divides an asset’s 3-year historical volatility by its 3-month historical volatility.

REKTelligence VOLticipation Ultra indicator = 3-year HV / 3-month HVA reading of 1.0 indicates that the 3-year historical volatility is equal to its 3-month historical volatility. The current high reading of 2.15 indicates that the 3-year historical volatility is over 2 times its 3-month historical volatility — a rare level and the highest we’ve seen since 2016.

The parallels to 2016 are growing.

BITCOIN (BTC/USD). Daily Chart with REKTelligence VOLticipation Ultra Indicator.

Let’s rewind to 2016. Again.

If we combine the 6-month range condition with the newly emergent VOLticipation Ultra indicator reading, the technical parallels between 2016 and 2023 look increasingly bullish.

On April 14th, 2016, Bitcoin’s VOLticipation Ultra Indicator broke above the 2.15 level, with price seemingly doing nothing. In fact, Bitcoin remained range-bound for another 43 days before eventually breaking out above the 470 level, starting an impressive run to 1000 by the first few days of 2017. One year later, Bitcoin nearly touched 20,000 — a 41x move.

BITCOIN (BTC/USD). Daily Chart with VOLticipation Ultra Indicator. 2016 - 2017.

Today, September 25th, 2023, Bitcoin’s VOLticipation Ultra Indicator hit 2.15, with price seemingly doing nothing. Similar to 2016, Bitcoin has been range-bound for over 6 months. Were a perfect parallel breakout to occur, we’d see a major upside breakout on November 8th — 44 days from now. A subsequent perfectly parallel run would carry Bitcoin to a closing high of 1,077,070 within two years — a 41x move.

Do we expect perfect parallels in any market? No. But analogs do occur in financial markets, and the cloud of disinterest currently hanging over crypto may soon evaporate.

The bullish parallels to 2016 are growing, however parallel the future may look.

HEY THERE! THANKS FOR READING. Please feel free to *SHARE* this report! We appreciate you spreading the word so we can continue to deliver this research. Cheers, DB

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC