IN TODAY’S REPORT

What we cover: TECHNICAL VIEW Edition. ETHBTC Weekly. Close Up. Implications for Ether. Most bullish chart in crypto.

TODAY’S TECHNICAL VIEW

ETHBTC’s Compelling Technicals

Like a hit single pinned at #1 on the Billboard Hot 100 for weeks on end, the crypto market’s dominant narrative remains the IMMINENT SPOT BITCOIN ETF APPROVAL with little to nothing else getting any airplay.

While this may be a Bitcoin Maximalist’s dream, it potentially risks missing one of the most powerful signals at play in the market right now.

Solana? 1000 Sats? No. It’s Ethereum’s technical position relative to Bitcoin, and the implications for Ether. Let’s take a look…

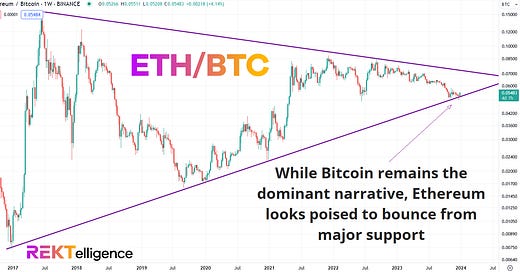

ETHEREUM/BITCOIN (ETH/BTC). Weekly Chart.

While many crypto analysts and BTC maxis alike call for Bitcoin dominance to continue to rise to heights not seen in years — Michael Saylor’s June 2023 call for Bitcoin dominance to hit 80%, for example — the more realistic and higher probability call may just be issuing a signal right now.

ETHEREUM/BITCOIN (ETH/BTC). Weekly Chart.

The long-term Ethereum/Bitcoin (ETHBTC) chart currently sits at major support. How major? ETHBTC refuses to close below the lower boundary of a symmetrical triangle which has been forming since the very inception of Ethereum. Why is this significant? Apart from this boundary having survived all prior tests, a ETHBTC move up from these levels would signify Ether’s outperformance relative to Bitcoin.

Early readers of the REKTelligence Report will find this statement familiar:

Bitcoin may rule the (apolitically) conservative, anti-fiat, rigidly fixed supply, better-denominator contest, but it’s Ethereum which rules the (apolitically) progressive evolution of modern finance.

It’s for this reason that the Ethereum/Bitcoin chart will one day become the most famous chart in crypto. Why? The inception-to-present, years-in-the-making symmetrical triangle pattern screams BULLISH BREAKOUT! just as loud as the 2019 to 2020 Bitcoin/U.S. Dollar daily chart whose large ascending triangle pattern broke out to eventually hit just shy of 70,000. Maybe louder.

ETHBTC will break to the upside eventually — almost certainly in the coming bull cycle — making a series of all-time highs as Ethereum closes the market cap gap with Bitcoin. But crypto is not a competition between Bitcoin and Ether. It’s a growing ecosystem which will continue to expand and revolutionize finance for the rest of this century and beyond.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC