Stats Suggest Bitcoin To Smash $100,000

IN TODAY’S REPORT

What we cover: STATS EDITION. Bitcoin’s current technical setup. Renewed hopium? Query results. Higher in 2024.

TODAY’S STATS

Cooler Data Ignites Bitcoin

Bitcoin, Ethereum, and most certainly the broader altcoin market have been in a palpable malaise since mid to late March. But widen the lens and both Bitcoin and Ether remain in bullish daily consolidations — no change.

But this week also saw cooler than expected inflation data, bolstering the idea that Fed rate cuts may still be coming in 2024. The data in turn sparked a Bitcoin rally back up above its 50-day moving average (50ma) to close at a 20-day high on Wednesday — an arguably significant short-term development.

The significance? In short, Bitcoin may be setting up to push to another all-time high.

Today’s report looks at historical closes at 20-day highs while closing above a falling 50ma, all while in an uptrend as defined by a rising one-year moving average. These conditions just occurred this week, and so we’ll see what they suggest going forward.

Let’s get to the stats!

BITCOIN (BTC/USD). Daily Chart with Today’s Query Conditions

To take a closer look at the future implications of the current setup, we need to run a simple test over all of Bitcoin’s reliable history from 2011 to the present. Our “query conditions” represent a basic definition of the technical state of BTCUSD. The simpler the conditions the more data points we get to consider (three conditions is our typical max).

First, our simple query conditions with a 180-day hold:

BITCOIN SETUP CONDITIONS

CONDITION 1: Bitcoin closes at a >= 20-day high

CONDITION 2: Bitcoin closes above its declining 50-day moving average (50ma)

CONDITION 3: Bitcoin's one-year moving average (365ma) is rising

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") 180-days laterSince 2011, Bitcoin has experienced these conditions 13 times — roughly once per year on average. On the chart below, we display all hypothetical trades since 2011, shown with a 180-day hold time. The dates below correspond to the hypothetical EXIT DATE of the setup (i.e., 180 days after the setup conditions have been met).

BITCOIN (BTC/USD). Today’s Conditions: All Trades w/ 180-day Hold. 2011-Now.

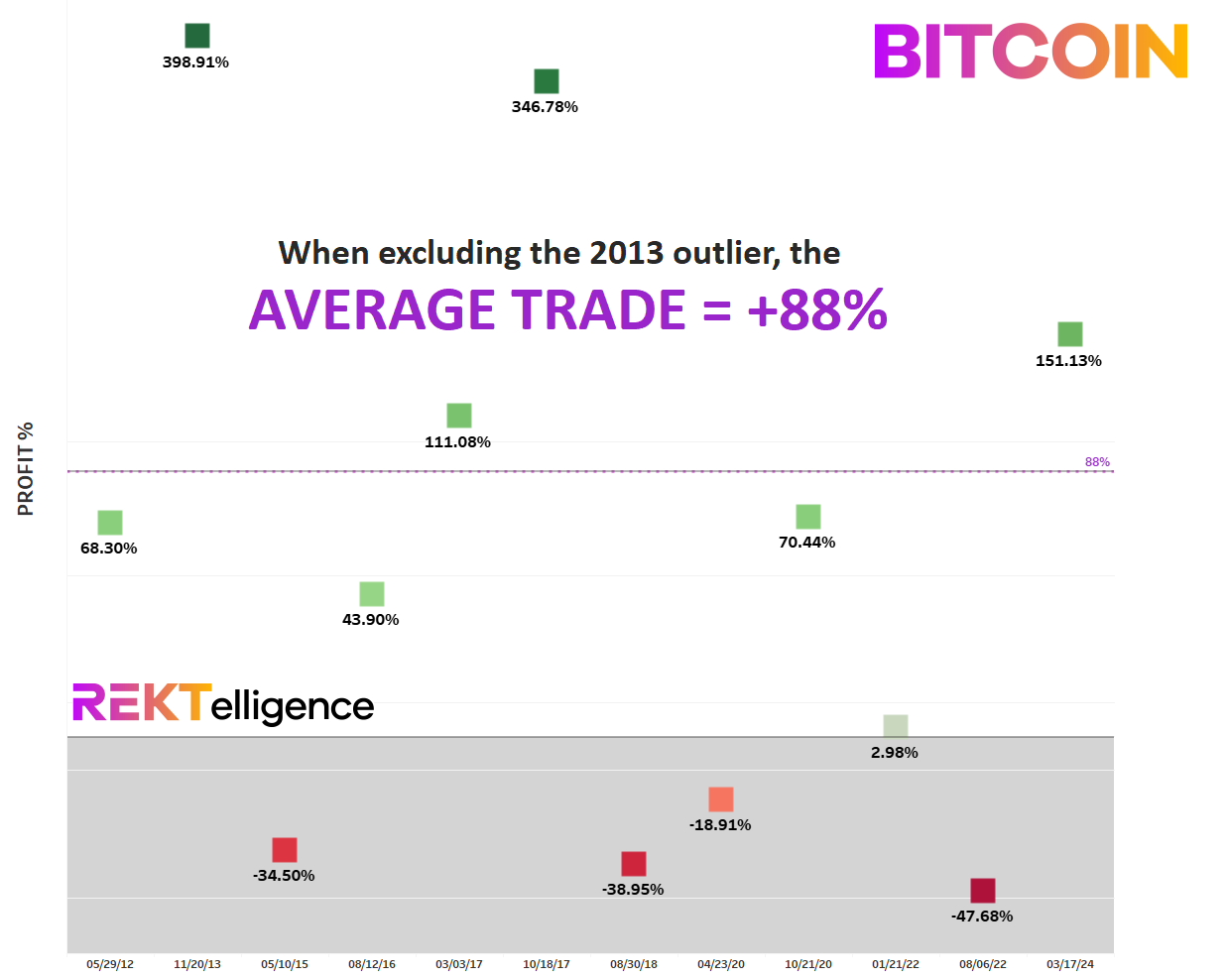

The largest gain under current conditions occurred in 2013 — the outlier of +872.09% — while the largest loss of -47.68% occurred recently during the 2022 bear market. While Bitcoin’s early years saw the greatest gains, the most recent trade of +151.13% was the fourth largest in Bitcoin’s history and occurred in March of this year.

With only 4 closed losses to date using our conditions, Bitcoin has gained following this setup precisely 69.23% of the time — nearly 7 out of 10 times.

Now let’s throw out the 2013 outlier from Bitcoin’s relatively early history and get an arguably more realistic look at what we might expect going forward.

BITCOIN (BTC/USD). All Trades w/ 180-day Hold, EXCLUDING OUTLIER. 2011-Now.

Tossing out 2013’s outsized trade of +872.09%, the average trade drops down to +88% using the same 180-day hold time.

That said, an 88% gain from Bitcoin’s current level of $67,300 (intraday May 17th, 2024) would put Bitcoin at $126,524 by November 2024.

Interestingly, all of the losses but one occurred during bear market winters, so this may improve the odds of success beyond the current 69.23% win rate when considering today’s bull market and the dramatically improved macro environment.

If you’ve been a regular reader of these stats-driven pieces, you’ve likely noticed a trend. The stats continue to suggest higher — potentially much higher — in 2024. Renewed hopium? Hardly.

Until next time…

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2024 REKTelligence LLC