IN TODAY’S REPORT

What we cover: PREDICTION Edition, Part 1.

TODAY’S CRYPTO PREDICTIONS

Happy 2024, REKTelligensia!

While I’m grateful to have arrived at another Bitcoin Halving Year — currently estimated to occur on 4/17/24 as another 210,000 blocks will then have been mined since 2020 — I’m also sick with a nasty cold and will make part 1 of my predictions brief and to the point

First, before any REKTelligence predictions, let’s look at the so-called prediction market Polymarket and its current bet: “Will a Spot Bitcoin ETF be approved by January 15th?” The answer? Yes, with an 80% probability according to real bettors on Polymarket. In light of multiple well-documented re-filings and back and forth exchanges between the thirteen ETF applicant companies and the SEC itself, this number appears spot-on, if you will.

POLYMARKET OPEN BET: “Spot Bitcoin ETH Approved By Jan 15?”; polymarket.com

Now, on to the predictions…

Prediction #1: Next Bitcoin Cycle High +133% Above Halving Day Price

The next Bitcoin cycle high will be roughly +133% above the price of Bitcoin on its 2024 Halving date. For example, if Bitcoin were to close at 50,000 on the day of its 2024 halving, the next cycle high will be approximately $116,500, or roughly +133% higher. Obviously, this is an estimate (and hopefully a conservative one). Here’s the rationale…

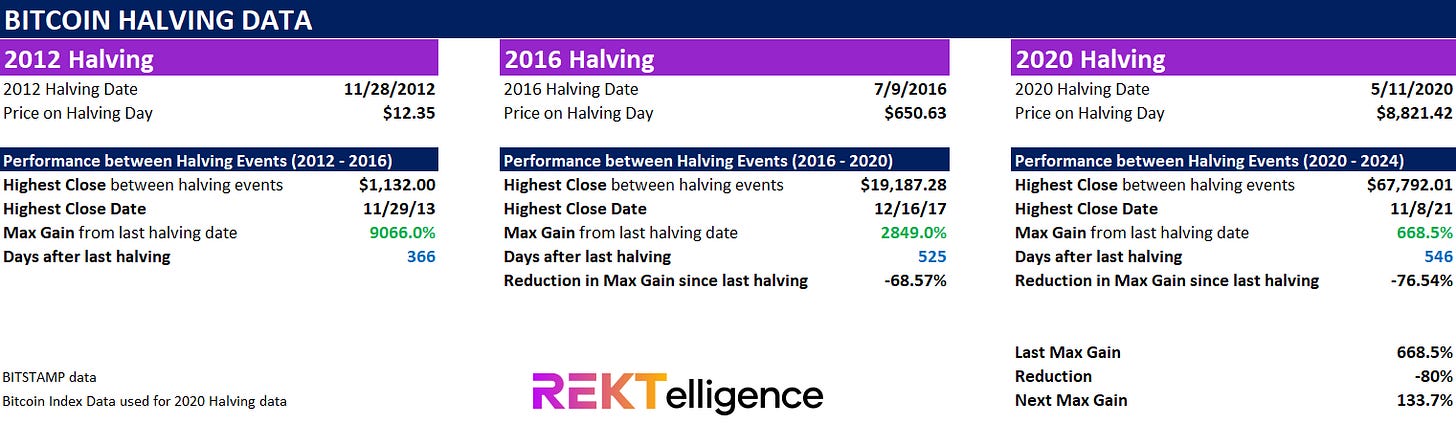

If we look at the maximum gain from each past halving day up to its subsequent bull cycle high, we see a pattern of robust but sharply diminishing gains.

2012 Halving Price to Subsequent High: +9066%

2016 Halving Price to Subsequent High: +2849%

2020 Halving Price to Subsequent High: +668.5%

The 2016 cycle gain is over 68.5% lower than the prior cycle while the 2020 cycle gain is over 76.5% lower than the 2016 cycle. Estimating the next cycle to see diminishing gains around -80% from the 2020 cycle, we arrive at a projection of +133% above this Spring’s halving day’s close. In light of the coming retail onramp into government-controlled Bitcoin ownership — spot crypto ETFs — hopefully this is a conservative estimate.

Prediction #2: Bitcoin Will Not Hit A New ATH in 2024 (but it will probably come close)

The last cycle highs for Bitcoin have occurred between 366 and 546 days following the preceding halving date. While the introduction of spot crypto ETFs could potentially accelerate this timeline, it’s more likely that we’ll see the next cycle high occur in 2025 than this year. Sorry to rain on the party but maybe consider adding patience to your Resolutions list.

Prediction #3: The Next Bitcoin Cycle High Will Occur In November Or December 2025

All prior cycle highs for Bitcoin have occurred in November or December. Give markets enough time and all prior guidelines get broken over time, but this we’ll stick to this timeline for now.

Prediction #4: ETHBTC Will Explode Up Out Of Its Massive Symmetrical Triangle By The End Of 2025

Perhaps my favorite crypto chart of all time, ETHBTC will eventually explode up and out of its massive symmetrical triangle pattern which has been forming since Ethereum’s inception.

While Ethereum dramatically underperformed Bitcoin in 2023 (up only 91% vs. 155% for $BTC) and now tests the lower boundary of this massive pattern, we believe that Ethereum will eventually outperform Bitcoin in equal parts due to the deflationary effects of 2022’s Merge (transition to Proof of Stake), the ability of investors to obtain a yield through no-lock staking, and the coming spot Ether narrative which lies ahead.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2024 REKTelligence LLC