IN TODAY’S REPORT

What we cover: Bitcoin closes at 365-day high. REKTelligence Stretch %. All trades. Remove the outlier.

TODAY’S STATS

So Many Signals

While our recent reports have discussed some of the many factors driving recent price improvement for Bitcoin, Ether, and selected altcoins, today we’ll unceremoniously dive right into the analysis. Why so brusque? After a long day of macro analysis at a conference in Chicago, time is limited and the brewery awaits. Alas, priorities…

After an impressive multi-day rally, Bitcoin finally achieved escape velocity above 30,000, closing at a 365-day high and over 19% above its 20-day moving average (20ma). Let’s take a look at how these conditions have fared in the past using a 90-day hold.

BITCOIN (BTC/USD). Daily Chart with REKTelligence Stretch % Indicator.

First, our two query conditions below. We’ll test these conditions over all reliable data from 2011 to now next.

BITCOIN SETUP CONDITIONS

CONDITION 1: Bitcoin closes at a 365-day high

CONDITION 2: Bitcoin closes >= 19% above its 20-day moving average

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") 90-days later

BITCOIN (BTC/USD). Historical Trades Based On Query Conditions, 2011-Now.

While three of the best trades occurred between 2011 and 2014, several of the less dramatically positive trades still remain impressive, with an average trade result of +189.89 using a 90-day hold time.

Far more impressive, however, is that the worst loss for one of the world’s most volatile assets under these conditions is only -16.98%. The average trade exceeds the worst loss by over 11x. For the risk-obsessed, this is damn compelling.

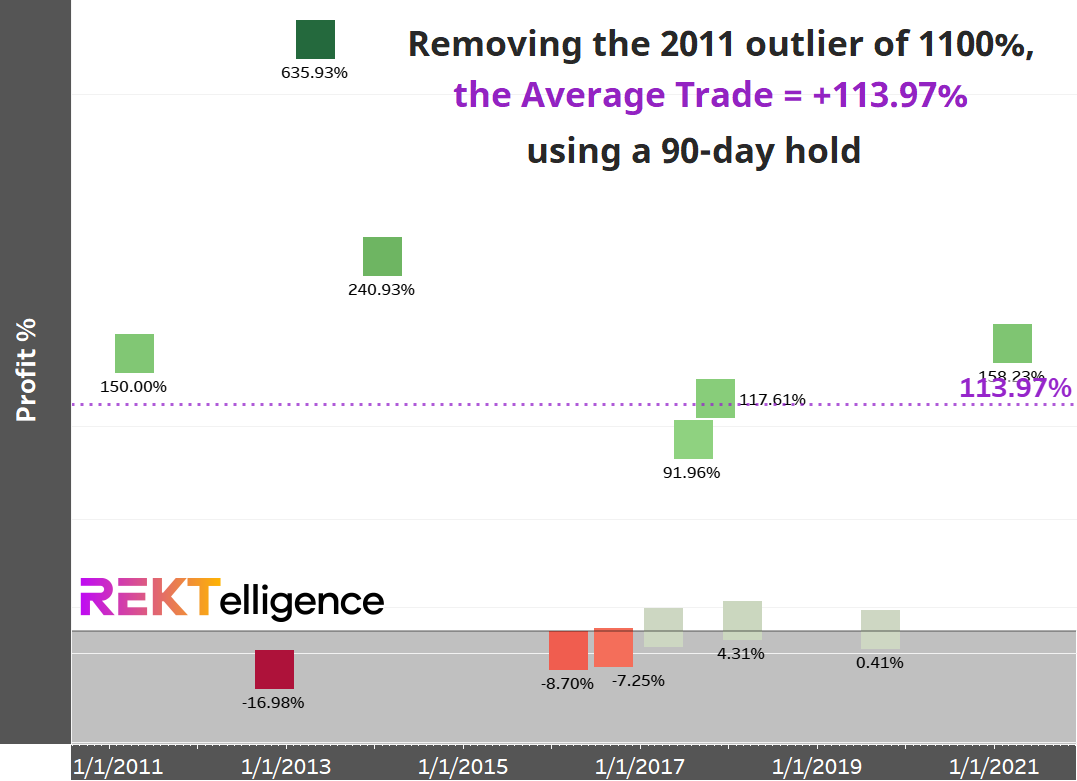

Now let’s remove the 2011 outlier of 1100% for a more conservative look.

BITCOIN (BTC/USD). Historical Trades with 2011 Outlier Removed, 2011-Now.

Even ditching the outlier trade, Bitcoin’s average trade easily tops +100% over this 90-day window. With just 3 losses in 13 closed trades, these conditions can be (relatively) safely called high probability, sporting a profitable percentage of 76.9%.

The signals grow, the evidence mounts, and the narratives increase. In the encroaching shadow of the profligate fiat world, the soundest asset looks poised to rise again — potentially soon.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC