IN TODAY’S REPORT

What we cover: Buying November 1st examined. Ether stats. SBF & future Novembers.

TODAY’S STATS

What If You Bought $ETH Every November 1st?

With “Uptober” successfully in the rearview mirror, we find ourselves once again in November, a month which still haunts crypto traders following the obscene collapse of high profile exchange FTX just one year ago.

As of last night’s verdict in which FTX founder Sam Bankman-Fried was found guilty on all seven counts, however, we can now celebrate November for the speed at which justice arrived at his Bahamian doorstep. Barring a successful appeal, SBF will now likely serve decades for his crimes and the reputational damage he inflicted on crypto — the most innovative asset class ever created.

Happily, future Novembers will not be remembered for SBF at all, but rather for future crypto innovations, the recurring anniversary of Satoshi’s ground-breaking white paper, and potentially for the continued propensity for November to be a solid entry point into Ethereum.

Today we’ll take a look at seasonality, hypothetically buying ETH on November 1st with a one year hold in order to find out whether such a late year entry has a positive or negative edge historically.

While we’ve basically already stated them, let’s define the conditions. Our simple query conditions below:

//QUERY CONDITIONS//

ENTRY CONDITION: Buy ETHUSD on November 1st at the open of the daily candle

EXIT CONDITION: Exit ("sell") just under one year later on October 31stLet’s begin with Ether’s hypothetical trade results, shown on a scatter plot below.

ETHEREUM (ETH/USD). “Buy November” with a 1-Year Hold Time. Inception-Now.

With five wins and three losses, a November 1st entry into ETH looks promising at first glance.

Best Result: +2712.2% (2016 - 2017)

Worst Result: -62.9% (2021 - 2022)

Average Result: +600.8%

Now let’s toss out the outlier for a more conservative look at the data.

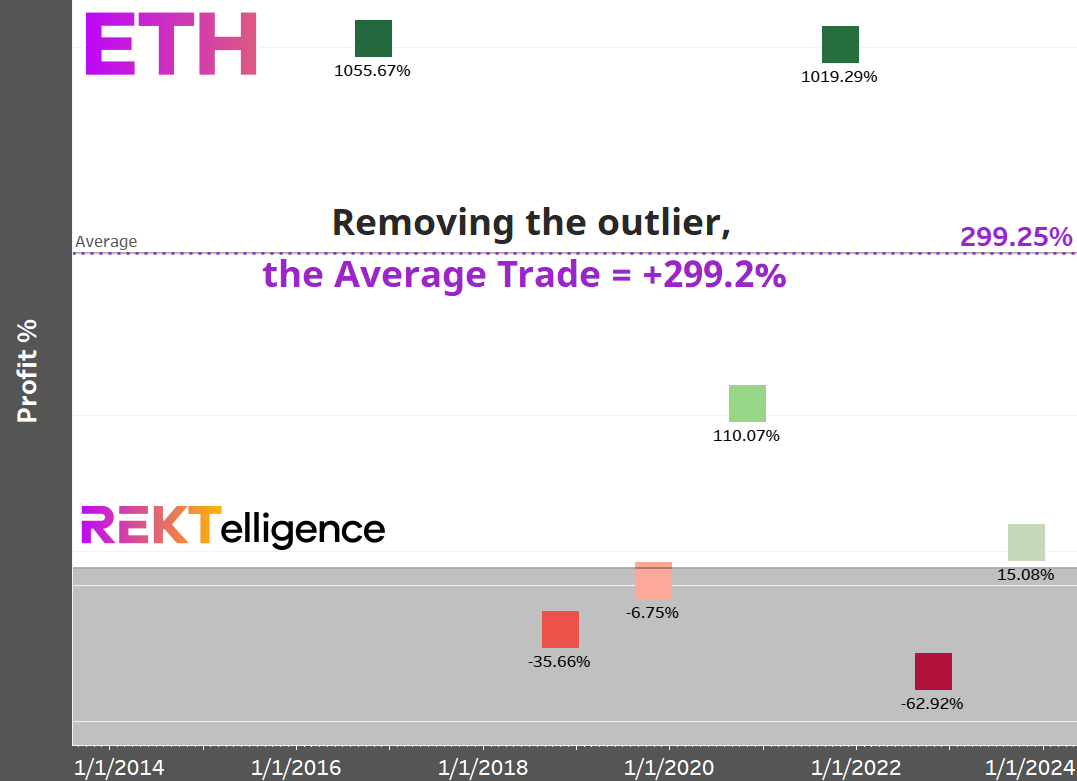

ETHEREUM (ETH/USD). “Buy November”, Remove Outlier. Inception-Now.

Removing the 2016 - 2017 outlier cuts the average trade in half, but the edge remains overwhelmingly bullish.

Best Result: +1055.6% (2015 - 2016)

Worst Result: -62.9% (2021 - 2022)

Average Result: +299.2%

Taking the opening price of ETHUSD on November 1st 2023 (1815) and applying both the average gain and average gain sans outlier, we could potentially see Ethereum reach 5431 all the way up to 10,905 by Halloween 2024.

Soon a prison guard will slam the door shut on a painful era. As the SBF nightmare comes to an end, however, the dream of crypto increasingly becomes a reality. Builders have never stopped building, despite his lies and treachery.

A new era for crypto begins today.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC