IN TODAY’S REPORT

What we cover: Ether’s technicals are a first. 160-day closing lows analysis. Average trade stats and win rate for ETH under similar conditions.

TODAY’S STATS

Ether Closes At 160-Day Low And Makes History

In a market that trades 24/7/365 there are very few firsts. But Ethereum’s downside bleed into this week — specifically yesterday’s close at a 160-day low while above its one-year moving average — was indeed a first. All prior closes at 160-day lows have occurred below the one-year moving average.

Being a first, naturally there’s no precedent to examine. No matching prior conditions to query. So we’ll relax our constraints today and look solely at what’s happened when Ether has closed at a 160-day low. This will provide a good though imperfect perspective on what we might expect moving forward.

ETHEREUM (ETH/USD). Daily Chart with One Year Moving Average (365ma).

First, our simple query condition below:

OUR ETHEREUM QUERY'S SETUP CONDITIONS

CONDITION 1: Ether closes at a 160-day low

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") N-days laterHere are the results with a variety of hold times:

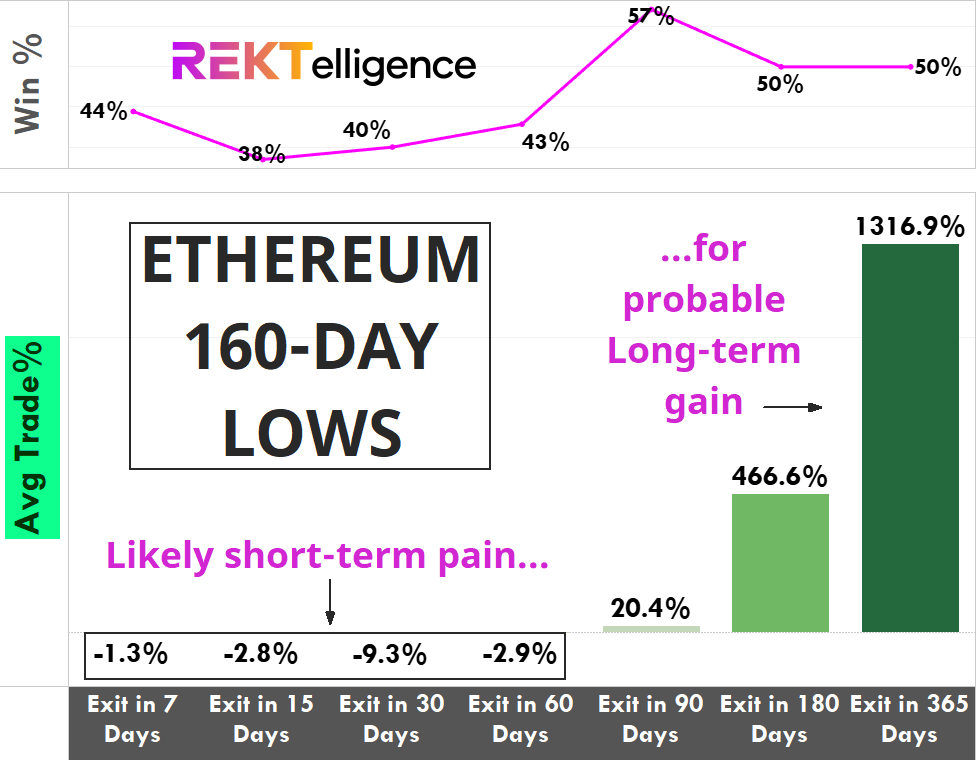

ETHEREUM (ETH/USD). Hold Time Results with Win % and Average Trade. Inception-Now.

Put simply, the historical picture is mixed. In the short to intermediate-term, the outlook for Ether after closing at a 160-day low is unquestioningly (though modestly) bearish. Win % is also under 50% for every hold time from 7 days through 60 days. History says to expect short-term pain.

Moving out to a 90-day holding time, there’s a glimmer of light with the average trade now positive at +20.4%.

But it’s the long-term hold that has historically delivered the stunning returns that Ether’s famous for, with average trade stats of +466% and +1316% using a 180-day hold and 365-day hold respectively.

While the win rate following 160-day lows leaves a lot to be desired, the average trade stats speak for themselves. First or not, we’ve got our mind set for likely short-term pain with an eye on probable long-term Ethereum gain.

P.S. HEY THERE! THANKS FOR READING. Please feel free to SHARE this report! We appreciate you spreading the word. Cheers, DB

THE TLDR

A Few Key Takeaways

✔ Win % is also under 50% for every hold time from 7 days through 60 days. History says to expect short-term pain. ✔ Moving out to a 90-day holding time, there’s a glimmer of light with the average trade positive at +20.4%. ✔ ETH's average trade stats of +466% and +1316% using a 180-day hold and 365-day hold respectively are impressive

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC