IN TODAY’S REPORT

What we cover: STATS EDITION. Ether just closed up >= +19% and at a 40-day high. Hypothetical trade stats. 2017 as analogue.

TODAY’S STATS

Buy The Rumor. Buy The News?

Ether’s stunning rise earlier this week was driven by a classic buy-the-rumor dynamic after Bloomberg analysts Balchunas and Seyffart upped the odds of spot ETH ETF approvals.

With spot Ethereum ETFs almost certainly now soon to begin trading following yesterday’s SEC approval of the 19b-4 forms related to the spot Ether ETF applications, we wanted to take a look at this week’s phenomenal swing higher and — most importantly — what it suggests going forward for the number two cryptocurrency.

Let’s get to the stats!

ETHER (ETH/USD). Daily Chart with Today’s Query Conditions

To take a closer look at the future implications of the current setup, we need to run a simple test over all of Ether’s history from inception to the present. Our “query conditions” represent a basic definition of the technical state of ETHUSD. The simpler the conditions the more data points we get to consider (three conditions is our typical max).

First, our simple query conditions with a 30-day hold:

ETHER SETUP CONDITIONS

CONDITION 1: Ether closes up >= +19% in a single day

CONDITION 2: Ether closes at a >= 40-day high

CONDITION 3: Ether closes above its rising 20-day moving average (20ma)

CONDITION 4: Ether closes above its rising 200-day moving average (200ma)

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") 30-days laterSince ETH’s inception, Ether has experienced these conditions just 6 times, a fairly rare event. Five of these occurrences have completed a full thirty days since signaling, while obviously the most recent instance which triggered at Monday’s close has not.

On the chart below, we display all of the completed hypothetical trades since inception, shown with a 30-day hold time. The dates below correspond to the hypothetical EXIT DATE of the setup (i.e., 30 days after the setup conditions have been met).

ETHER (ETH/USD). Today’s Conditions: All Trades w/ 30-day Hold. Inception-Now.

The largest gain of +183.18% under current conditions occurred in 2017 while the only loss of -35.32% occurred early in Ether’s history (2016). All closed gains exceed +50% in just 30 days — a remarkable stat, even if not statistically significant.

With only 5 completed trades to date using our conditions, Ether has gained following this setup precisely 80% of the time ( 4 out of 5 times), with an average trade of +69%.

Now let’s take a look at totals by year, below.

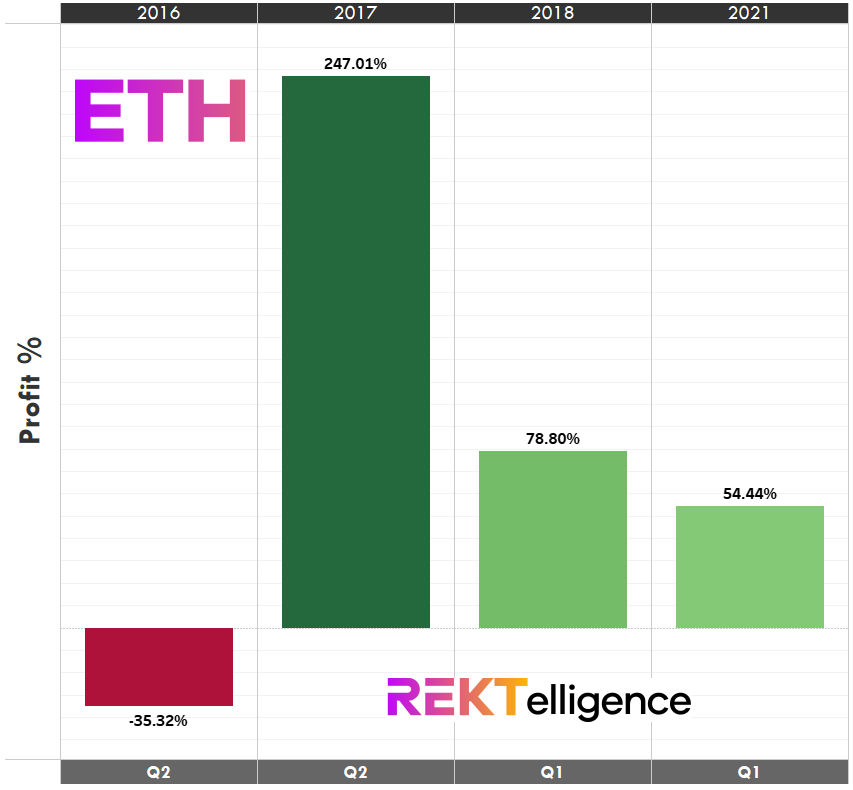

ETHER (ETH/USD). Today’s Conditions: Totals By Year w/ 30-day Hold. Inception-Now.

Clearly 2017’s surging bull market racks up the greatest gains under these test conditions, a potential harbinger for things to come as the global macro backdrop continues to improve, inflation shows signs of cooling, new regulated onramps into the crypto space get approved, and following last month’s supply cut for Bitcoin (i.e., the halving).

In short, with 2017 arguably being the closest analog to today’s market backdrop, we may see more +19% days and 40-day closing highs in the next several months.

All to say, if history rhymes and we get a +69% gain from Monday’s closing levels, we could see Ether hit $6186 by late June.

Our takeaway? Hold tight and #HODL the hell on.

Until next time…

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2024 REKTelligence LLC