IN TODAY’S REPORT

What we cover: Defining current ETH conditions. Stats for buy and hold vs. current conditions with 180-day hold. Removing outliers. Powerful edge at work.

TODAY’S STATS

Bitcoin Hogs Spotlight, But…

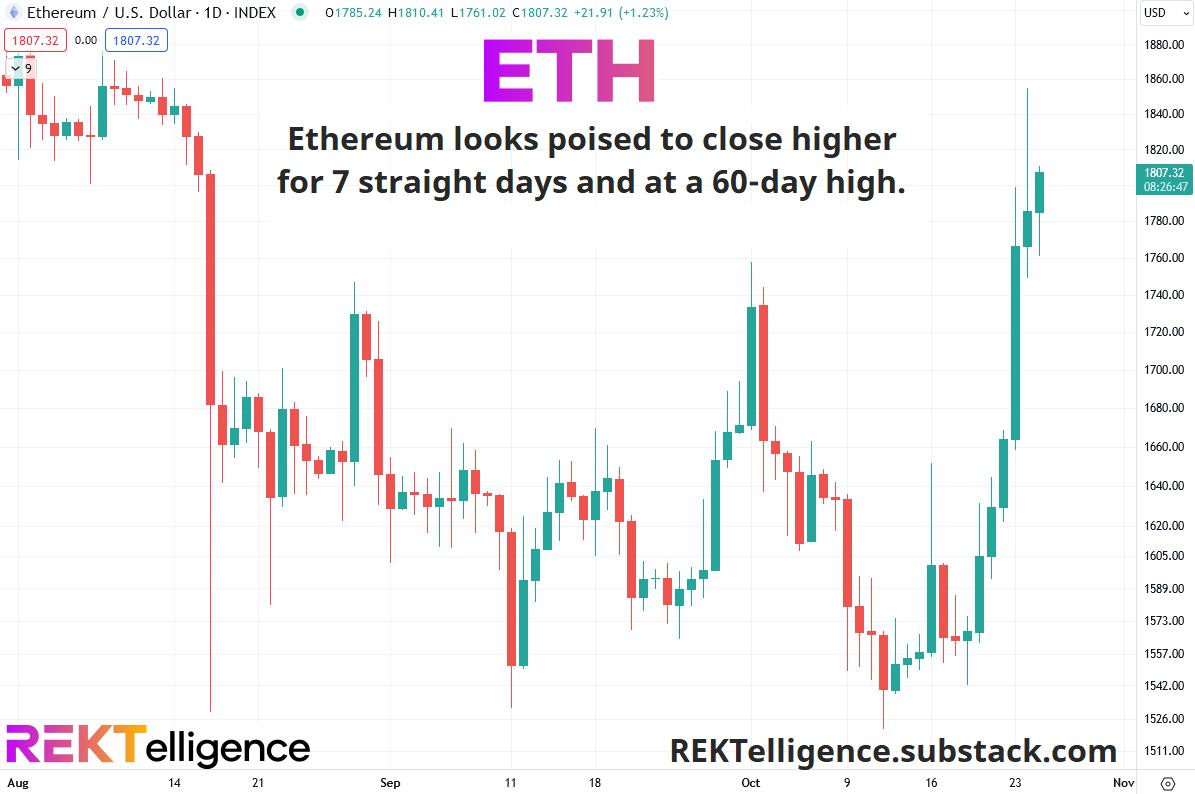

For obvious reasons, Bitcoin continues to hog the spotlight as it awaits spot ETF approval and tests the 35,000 level in anticipation. Behind the curtain, however, Ethereum steadily gains traction and now looks poised to close higher for 7 straight days and at a 60-day high. This has only occurred five times before in all of Ethereum’s history.

Doing quantitative analysis of turbo-charged assets like Bitcoin and Ether routinely — but not always — leads to highly compelling stats and mouth-watering potential returns. To better ground our readers’ future expectations, we often compare trade hypothetical results to a simple buy and hold approach with a matching holding period. We’ll do the same comparison today.

ETHEREUM (ETH/USD). Daily Chart with Today’s Conditions.

First, to take a closer look at the future implications of the current setup, we need to run a simple test over all of Ethereum’s history from inception to the present. Our “query conditions” represent a basic definition of the technical state of ETHUSD. The simpler the conditions the more data points we get to consider (three conditions is our typical maximum).

First, our simple query conditions below:

ETHEREUM SETUP CONDITIONS

CONDITION 1: Ether closes higher for 7 straight days

CONDITION 2: Ether closes at a 60-day high

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") 180-days laterAs noted, Ether’s prior trades are few in number. Today’s conditions are rare, occurring less than once per year.

ETHEREUM (ETH/USD). Today’s Conditions: All Trades w/ 180-day Hold. Inception-Now.

While this means we cannot rely on their statistical significance, we can’t help but be impressed with the average trade of +437.03%. Even removing the not-too-distant outlier (occurred in 2017), the average trade is +75.99% with only a single loss.

ETHEREUM (ETH/USD). Buy & Hold: All Trades w/ 180-day Hold. Inception-Now.

Buy and hold results for Ether come in much lower at +173.35. Removing the buy and hold outlier, the average buy and hold trade comes in at +59.37% — once again lower than current conditions.

Like we showed in Monday’s Bitcoin-focused letter, the bullish run in both assets suggests a powerful upside edge at work. Six months from now — roughly 180 days — puts us just beyond Bitcoin’s next halving event, and if — a big if, of course — the average holds up we’ll see Ethereum hit 7809. Any objections?

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC