IN TODAY’S REPORT

What I cover: TECHNICAL ANALYSIS / STATS Edition. Bitcoin following U.S. Dollar Index weakness.

Today’s Key Charts

With gold making new highs, stocks struggling to remain out of bear market territory, and most of crypto either consolidating or declining year to date, you’ll frequently read headlines along the lines of Gold Makes New Highs While Bitcoin Fails, or Bitcoin A Safe Haven? Think Again and so on.

But Bitcoin’s lengthy consolidations serve as an effective deterent to the impatient. With micro attention spans, many would-be investors simply move on without ever getting on board.

Fast forward to yet another ugly plunge in the U.S. Dollar today, and it appears that HODLers will soon get rewarded for their patience. Bitcoin now breaks up out of a down channel with expanding range as the U.S. Dollar continues its descent.

Today I examine U.S. Dollar (DXY) declines and what Bitcoin has done in the 90 days afterwards.

Let’s take a look…

BITCOIN Daily Chart with 50ma, 365ma.

As I write, Bitcoin breaks up out of its multi-week down channel on expanding range while it easily clears its falling 50-day moving average. This follows roughly a week of tight sideways price action as Bitcoin pressed against resistance.

TAKEAWAY: If this breakout can hold, Bitcoin may now start an ascent back toward its post-election highs just as it passes the Halving Quarter Point, a significant demarcation line I recently wrote about (The Bitcoin Quarter Point).

U.S. Dollar Index (DXY). Daily Chart. Late 2024 - Now.

The U.S. Dollar decline comes amid a U.S. trade war waged at friend and foe alike, declining equities and bonds (i.e. rising rates), and corporate and retail uncertainty near all-time highs. In fact, with earnings season now in full bloom, many companies have abandoned all guidance for no other reason than an inability to make reasonable forward-looking statements.

TAKEAWAY: The causes behind the U.S. Dollar decline are arguably many as the DXY now trades at levels not seen since early 2022. A sustained period of weakness for the DXY may help crypto assets moving forward.

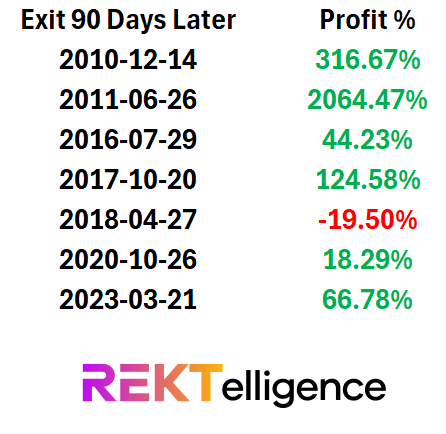

BITCOIN Hypothetical Trades Following DXY Decline. All Available Data 2010-Now.

When the U.S. Dollar Index (DXY) has closed down >= -6% within 90 days, buying Bitcoin (BTCUSD) and exiting 90 days later has produced overwhelmingly positive results. While the DXY’s current decline exceeds -6% within 90 days, this lesser threshold serves to provide more data points for a better look at Bitcoin’s behavior following sudden DXY weakness.

TAKEAWAY: While instances are limited, Bitcoin has experienced impressive gains following sudden and pronounced DXY weakness.

While the laser-eyed may dream of it, Bitcoin doesn’t require the abandonment of the U.S. Dollar as the world’s reserve currency.

But the recent sudden and sharp downside for the USD may be just what the Bitcoin bulls needed.

Until next time…

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2025 REKTelligence LLC