Buckle Up. Bitcoin Just Completed This 5 Month Pattern.

IN TODAY’S LETTER

What we cover: Bitcoin just completed a 5-month pattern. Results when buying Bitcoin with various monthly hold times. Reward vs. Risk appears to be a no brainer, though traders must consider their own situations carefully.

TODAY’S STATS

Bitcoin 4 Months Up + 1 Month Down? Impressive Results.

Bitcoin just closed lower for the first time in five months, following four consecutive up months in January, February, March and April. For most Bulls, last month’s damage will be considered mild and more a test of patience than a reason for despair, as Bitcoin shed -6.94% in May. With this setup in mind, we’ll conduct our first monthly study, taking a look at how Bitcoin has performed historically after four straight months up has been followed by one month down. Let’s run the stats!

BITCOIN (BTC/USD). Monthly Chart with Today’s Query Conditions.

OUR BITCOIN QUERY'S SETUP CONDITIONS:

CONDITION 1: Bitcoin closes higher for 4 straight months, then...

CONDITION 2: Bitcoin closes lower for one month

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") 6 months laterHere are the results using a 6-month hold:

BITCOIN (BTC/USD). Query Results for BTC with a 6-month Hold. 2011-Now.

Using a 6-month hold, the 9 historical occurrences have been overwhelmingly profitable, up 77.8% of the time since the start of reliable Bitcoin data (2011 - now). In all of Bitcoin’s reliable data history, the worst trade following this monthly setup is only a modest -12.9% when using a 6-month hold. Again, this is the worst result. Bitcoin shed over half of that just last month without much fanfare. The average historical gain in this timeframe impresses at over +317%, but it is the stratospheric Profit Factor of 140.9 which indicates that the sum of all hypothetical gains is over 140 times the sum of all hypothetical losses. Wow. While instances are low at only nine, a reading this high is nevertheless exceedingly rare, and arguably immensely bullish. From a Reward vs. Risk perspective, this setup appears to be a no brainer. That said, traders should examine their own situations carefully and act accordingly.

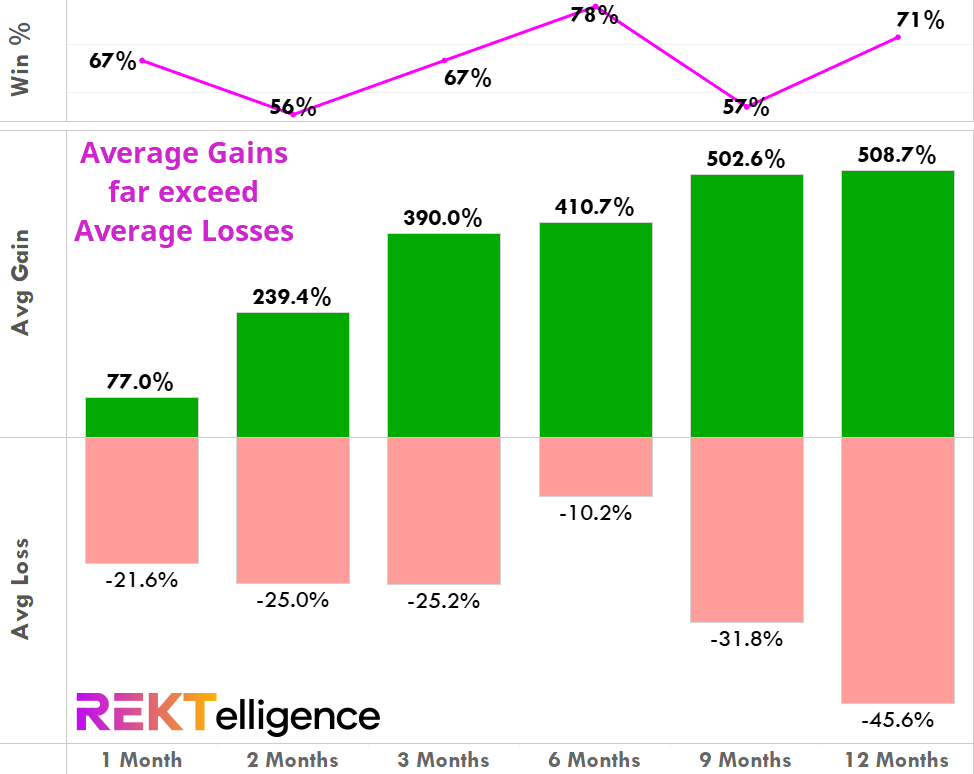

Now let’s look at Bitcoin’s results for Average Gain and Average Loss across various holding times ranging from 1 month to a year using data from 2011- Now. Note that the Win % shows how many trades were profitable, hypothetically speaking.

BITCOIN (BTC/USD). Monthly Hold Time Results for Today’s Conditions. 2011-Now.

Across the board, the average gains easily (and far) exceed the average losses. The worst average loss value for the four hold times which we examined from one month through six months is a reasonable -25.2%. The nine month and twelve month holds see improved average gains but also have delivered far greater average losses, lessening the appeal for any hold beyond six months based on this monthly setup. The probability for profitability (Win %) remains favorable across the board, with the lowest winning percentage of 56% still beating a fair coin toss. While nine historical instances may be low, the results are tough to argue with.

THE TLDR

A Few Key Takeaways

✔ Using a 6-month hold, the 9 historical occurrences have been overwhelmingly profitable, up 77.8% of the time ✔ The worst trade following this setup is -12.9% when using a 6-month hold ✔ From a Reward vs. Risk perspective, this setup appears to be a no brainer ✔ While nine historical instances may be low, the results are tough to argue with

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC