Bitcoin Volatility In The Retail Era

IN TODAY’S REPORT

What we cover: VOLticipation UT Indicator overview and signals.

THE TECHNICAL VIEW

VOLticipation UT Indicator May Soon Hit Rarely Seen Level

Our Monday analysis continues to hold post-FOMC announcement as Bitcoin remains above the new short-term support of 29,000 and below the 30k mark.

With the bears now in the short-term driver’s seat ahead of this week’s Fed decision, the recent battle for 31,000 suddenly looks more like an upcoming battle to hold 29,000. Wednesday’s FOMC rate announcement will see a 25 basis point hike and most likely bring the committee one step closer to issuing its final rate bump later in 2023. The tightening cycle ain’t over yet, but the end appears reasonably near. [7/24/23]

While the loss of 30,000 may appear meaningful to the leveraged day trading crowd, it’s arguably meaningless in the grand scheme of things. Above all the noise, however, the big picture for crypto continues to take shape by the week, both fundamentally and technically. Having already covered the USA’s ongoing regulatory legal stew and the game-changing Blackrock spot Bitcoin ETF application in recent reports, we’ll focus today’s report on a long-term technical indicator once again demanding our attention.

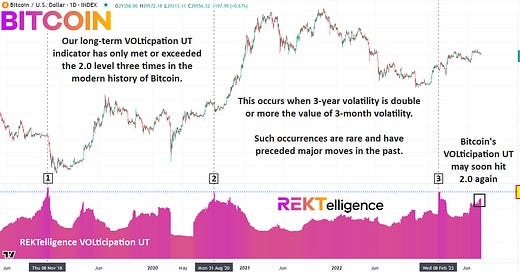

Measuring the relationship between long-term historical volatility and intermediate-term historical volatility, our VOLticpation UT indicator shows us occasional disparities between long and intermediate-term volatility trends.

Because Bitcoin bubbled up into the retail public’s consciousness for the first time in a meaningful way in 2017, we’ll refer to the period from then to now as the Retail Era. This is relevant, as Bitcoin’s VOLticpation UT indicator has only met or exceeded the 2.0 level just three times in the Retail Era. This reading occurs when 3-year volatility is double or more the value of 3-month volatility.

BITCOIN (BTC/USD). Daily Chart with REKTelligence VOLticipation UT Indicator.

Past peaks at or above the 2.0 level have preceded major Bitcoin price moves — both up and down — in the Retail Era.

2018’s spike to 2.13 on November 8th preceded a massive selloff as the 6000 level gave way, delivering another 50% haircut in an already brutal year for crypto

August 31st 2020’s spike to 2.00 initially preceded a quick drawdown back below 10,000 before setting up Bitcoin’s first run to above 60,000

Since the last spike to 2.02 on February 8th of this year, Bitcoin has risen from just below 23,000 to nearly 32,000 at its high so far

With the VOLticpation UT now at 1.81, Bitcoin may be at the cusp of another signal, and subsequent major price move. While naturally a price retreat could be what follows, we believe that sub-30,000 pricing is temporary, and likely not available for too long.

THE TLDR

A Few Key Takeaways

✔ VOLticpation UT indicator has only met or exceeded the 2.0 level just three times in the Retail Era for Bitcoin ✔ Past peaks at or above the 2.0 level have preceded major Bitcoin price moves — both up and down — in the Retail Era ✔ With the VOLticpation UT now at 1.81, Bitcoin may be at the cusp of another signal, and subsequent major price move

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC