IN TODAY’S REPORT

What we cover: Defining current conditions. Stats for buy and hold vs. current conditions. 2011-now, 2018-now, 2021-now. Pressing the limits and escape velocity.

TODAY’S STATS

Third Time’s The Charm?

Once again Bitcoin attacks the 31,000 level. But we’ve been here before: in April, in June/July, and now in late October. Is this third time the charm? Will Bitcoin be able to sustain a lasting breakout and hold up for more than just a few days above the 31,000 level, or once again just burn up in the atmosphere?

Before we attempt to answer that question, we’ll look at how Bitcoin is currently attacking the level. Midday today (10/23/23) , Bitcoin looks poised to close higher for 5 straight days and gain more than +8.5% within 7 consecutive days. Any close tonight even close to current levels (~31,355) constitutes some degree of success.

With the current technicals in mind — 5 straight days up and more than +8.5% inside a week — let’s take a data-driven look at the stats of this setup. Does it suggest a downside retracement? Further upward momentum? If the latter, does it beat a simple buy and hold?

BITCOIN (BTC/USD). Daily Chart with Today’s Conditions.

To take a closer look at the future implications of the current setup, we’ll run a simple test over Bitcoin’s reliable data history from 2011 to the present as well as over more recent data periods. Our “query conditions” represent a basic definition of the technical state of BTCUSD. The simpler the conditions the more data points we get to consider (three conditions is our typical maximum).

First, our simple query conditions below:

BITCOIN SETUP CONDITIONS

CONDITION 1: Bitcoin closes higher for 5 straight days

CONDITION 2: Bitcoin gains >= +8.50% within 7 days

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

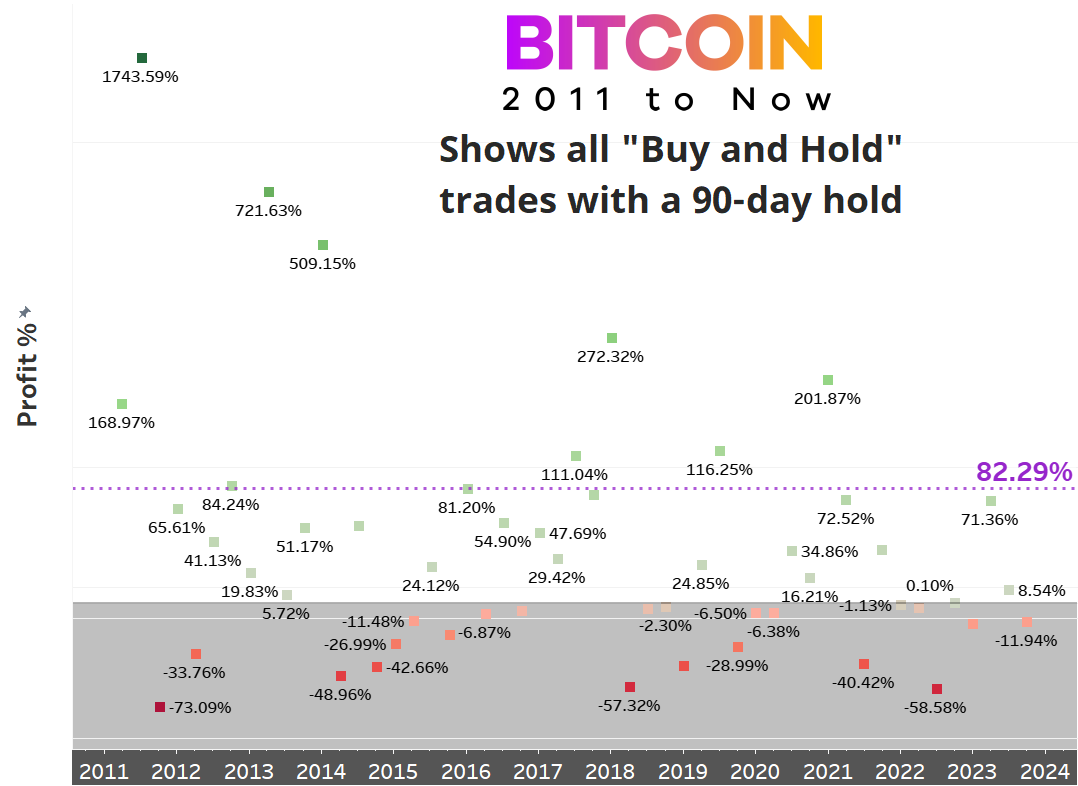

2. EXIT CONDITION: Exit ("sell") N-days laterBefore we take a look at trades matching Bitcoin’s setup right now — our query conditions — let’s examine all Buy and Hold trades using a 90-day hold time. This means we’ll hypothetically buy Bitcoin and exit 90 days later no matter the technical setup, or whether the king crypto is in a bull or bear market. Why do such an obviously naïve thing? Because it gives us a baseline.

In other words, are today’s conditions superior or inferior to a buy and hold approach using a 90-day hold? Below we’ll see three windows of results, all showing Buy and Hold next to today’s setup conditions: 2011 - now (all reliable data for Bitcoin), 2018 - now (roughly last 5 years), and 2021 - now (roughly last 3 years).

Focus on the horizonal dashed line representing the average trade result for both Buy and Hold and our Query Conditions.

BITCOIN (BTC/USD). Buy and Hold Trades vs. Query Conditions. 2011 - Now.

Results: 2011 - Now.

Buy & Hold Average Trade: +82.29%

Today’s Setup Conditions Average Trade: +141.53%

The average trade for Today’s Setup Conditions beats Buy & Hold by 59.24%

BITCOIN (BTC/USD). Buy and Hold Trades vs. Query Conditions. 2018 - Now.

Results: 2018 - Now.

Buy & Hold Average Trade: +24.08%

Today’s Setup Conditions Average Trade: +38.10%

The average trade for Today’s Setup Conditions beats Buy & Hold by 14.02%

BITCOIN (BTC/USD). Buy and Hold Trades vs. Query Conditions. 2021 - Now.

Results: 2021 - Now.

Buy & Hold Average Trade: +21.75%

Today’s Setup Conditions Average Trade: +65.32%

The average trade for Today’s Setup Conditions beats Buy & Hold by 43.57%

Clearly, today’s setup has the edge. But this doesn’t necessarily mean that Bitcoin busts right through 31,000 and never looks back. While that’s a possibility, expect at least some turbulence in this area. The 31,000 has seen rough air before and we may see it again.

That said, nothing gets out of the atmosphere without escape velocity. Much like jazz sax pioneer John Coltrane can be heard pushing furiously — and beautifully — against the harmonic and stylistic limits of the quaint standards the Miles Davis quintet performed all across Europe in 1960 (“The Final Tour: The Bootleg Series” by Miles Davis),

Bitcoin — the most innovative money ever created — now appears to be pushing against the upper boundary of its months-long trading range. Innovation pressing against its restraints. Genius on the cusp.

Know that Bitcoin currently has the statistical edge. And we may be about to see if it also has the escape velocity to ascend. Time to put away The Final Tour and cue up Coltrane’s late masterpiece Ascension. The future’s about to unfurl.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC