IN TODAY’S REPORT

What we cover: False report drives real gains. Massive high-low range. Query conditions. Removing the outlier. Trades scatter.

TODAY’S STATS

Massive Bitcoin Range = Signal

A false report by Cointelegraph early Monday quickly drove Bitcoin to above the critical 30,000 level for a moment before falling back shortly thereafter.

While the news may have been false, the price action and massive low to high range remain real — and as we’ll see below — a potentially significant signal.

BITCOIN (BTC/USD). Daily Chart with Extreme High-Low Range Reading.

To take a closer look at the future implications of the current setup, we’ll run a simple test over Bitcoin’s reliable data history from 2011 to the present. Our “query conditions” represent a basic definition of the technical state of BTCUSD. The simpler the conditions the more data points we get to consider (three conditions is our typical maximum).

First, our simple query conditions below:

BITCOIN SETUP CONDITIONS

CONDITION 1: Bitcoin's one-day range >= +9.50%

CONDITION 2: Bitcoin closes higher than yesterday

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next candle

2. EXIT CONDITION: Exit ("sell") N-days laterWhen we run our test over Bitcoin’s historical data, we get these results using a variety of hold times. For those new to our work, here’s a quick guide:

Win %: This shows the percentage of hypothetical trades which were profitable when exited “N-Days” later. For example, if someone bought Bitcoin each time all today’s query conditions were met in the past and exited 90 days later, Win % shows how many of those trades with have been profitable.

Average Trade %: Shows the average trade result for various hypothetical hold times (i.e., for a 7-day hold, 15-day hold, 30-day hold, 60-day hold, 90-day hold, 180-day hold, and a 365-day hold).

BITCOIN (BTC/USD). Average Trade Results Over Various Hold Times. 2011-Now.

From 2011 to the present, Bitcoin’s average hypothetical trade results are positive across all hold times we examine.

But a look at the magnitude of average gains vs. average losses following our query range conditions reveals far more. Hold times ranging from just 7 days through 90 days show relatively mild average losses under -20%. Average gains far outweigh average losses and with a consistently high Win %, indicating a strong probability of further upside with modest downside following Monday’s action.

BITCOIN (BTC/USD). Average Gain and Loss Results. Various Hold Times. 2011-Now.

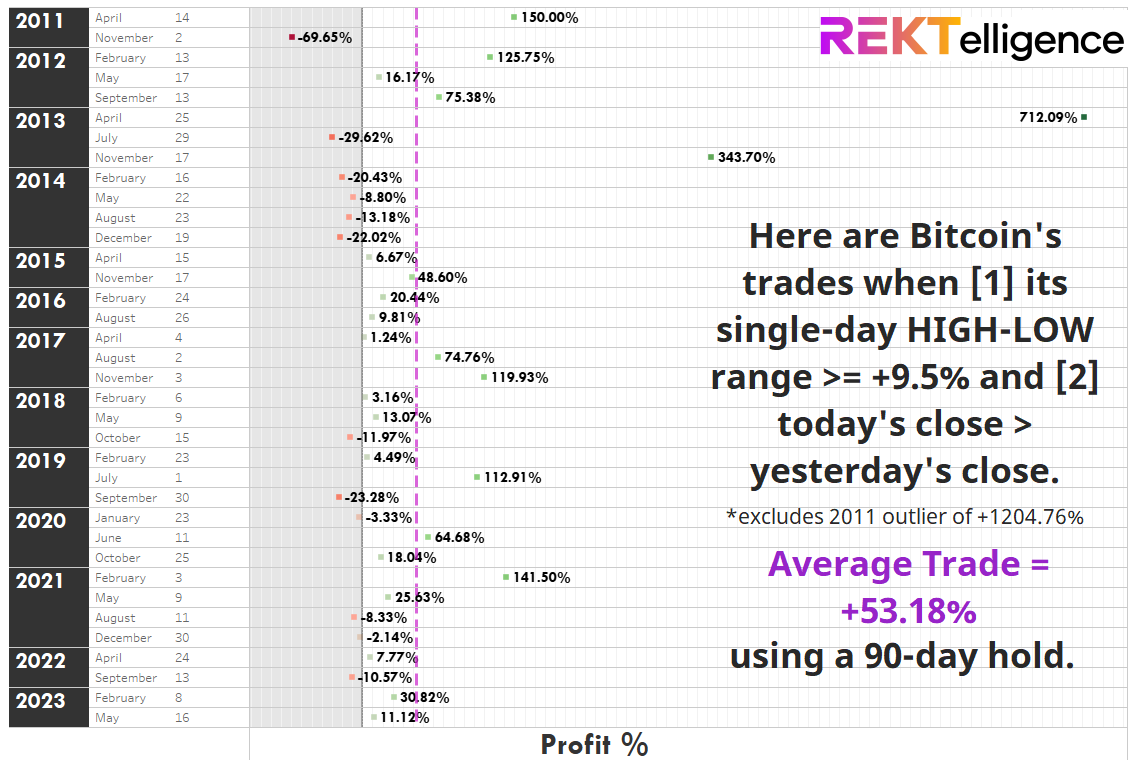

Now let’s turn our focus to the medium-term holding period of 90 days. Below are the hypothetical trade results for every time we’ve seen these query conditions in Bitcoin, 2011 to now. For more a more conservative view, we’ve eliminated the 2011 outlier (i.e., excluding the single +1204.76% gain).

BITCOIN (BTC/USD). Trades History with a 90-Day Holding Time. 2011-Now.

Note that the worst losses occurred long ago, particularly in 2011, 2013 and 2014. In fact, recent years show a strong upward skew with several gains over +100%.

Many have made predictions on when or if the first spot Bitcoin ETF will be approved. Few would have predicted that a false report would drive Bitcoin significantly higher even after the report was corrected.

Even fewer will be armed with the exceedingly compelling probabilities revealed by today’s action. Whether HODLer or trader, the stats suggest that Bitcoin once again appears poised to challenge significantly higher prices going forward.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC