Bitcoin Breaks Higher From Narrow Base. Next Leg Up?

IN TODAY’S REPORT

What we cover: Bitcoin’s 20-day range falls below 4.25%. Current conditions vs buy and hold. Worst trade comparison.

TODAY’S STATS

Bitcoin’s 20-Day Range Falls Below 4.25%

Threatening to close above the key 31,000 level for only the second time this year, Bitcoin’s basing action has continued in a narrow range all week even as it currently pumps higher intraday.

Today we look at the extended drop in Bitcoin’s closing range, more specifically what the 20-day range falling to below 4.25% means historically. We’ll examine all data and outcomes before comparing them to a simple buy and hold strategy. Let’s dive in!

BITCOIN (BTC/USD). Daily Chart with 20-Day Range <= 4.25% with 365ma.

Our range condition is simple, with two additional filter conditions which best describe the current market. Specifically, Bitcoin’s narrow ranging action takes place above its one-year moving average (365ma) which is also rising, indicating an improving market over the past 12 months.

QUERY SETUP CONDITIONS:

CONDITION 1: Bitcoin's 20-day closing range <= 4.25%

CONDITION 2: Bitcoin is above its 365-day moving average

CONDITION 3: Bitcoin's 365-day moving average is rising

ENTRY AND EXIT CONDITIONS:

1. ENTRY CONDITION: Enter long ("buy") at the open of the next daily candle

2. EXIT CONDITION: Exit ("sell") N-days laterBITCOIN (BTC/USD). Average Trade Comparison, Current Conditions vs “Buy and Hold”

Looking at hypothetical average trade results, both the current conditions and a buy and hold approach have historically produced modestly positive outcomes over the short-term (7 to 30 days).

Over intermediate to long-term hold times from 60 days to one year, hypothetical average trade results using current conditions beat the buy and hold results in every period but one, with increasingly impressive results.

But when we look under the hood at the single worst loss for current conditions compared to the same for buy and hold, the difference is stunning.

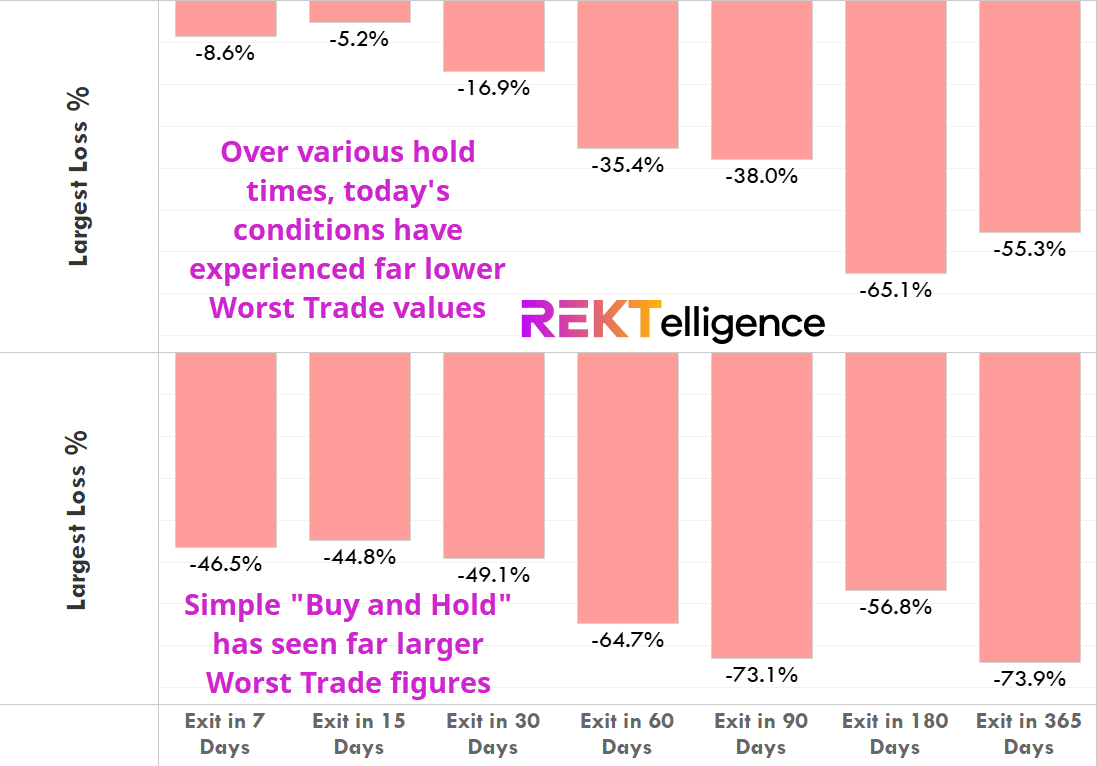

BITCOIN (BTC/USD). Worst Trade Comparison, Current Conditions vs “Buy and Hold”

Worst trade stats for Bitcoin’s current conditions using short-term hold times (7 to 30 days) have never exceeded -16.9%. Compared to buy and hold’s worst trade of -49.1% over the same window, the current conditions appear to have a dramatically lower risk exposure - something any experienced trader will appreciate.

Looking at all hold times, Bitcoin’s current setup has experienced lower worst trade stats nearly across the board, with buy and hold only beating it once (180 day hold).

In short, Bitcoin looks poised for a high base breakout, with a probability of only modest downside using 7 day through 90 day holds. With 31,000 once again in Bitcoin’s sights and the king crypto currently trading above it, we may be at the start of the next leg up. Let’s go.

THE TLDR

A Few Key Takeaways

✔ Worst trade stats for Bitcoin’s current conditions using short-term hold times (7 to 30 days) have never exceeded -16.9% ✔ Compared to buy and hold’s worst trade of -49.1% over the same window, the current conditions appear to have a dramatically lower risk exposure ✔ With 31,000 once again in Bitcoin’s sights and the king crypto currently trading above it, we may be at the start of the next leg up.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC