IN TODAY’S REPORT

What we cover: TOTAL3, the REKTelligence AltCap Index, SOL, TRX, LINK. The novice trader vs the veteran trader.

TODAY’S TECHNICAL VIEW

Early Altcoin Season Has (Finally) Arrived

As last year’s cold, bleak crypto winter dragged on amid headlines proclaiming the total collapse of not just FTX but crypto itself, 2023 arrived with a welcome bang. Bitcoin and Ether rallied from subterranean bear market territory, doubling within weeks from their worst levels. Some well-known crypto personalities even proclaimed that “alt season has arrived.”

As we argued earlier this year, however, Alt Season it wasn’t:

TOTAL3 shows the Total Crypto Market Cap excluding Bitcoin and Ethereum, providing us a good view of the altcoin space. As we’ve highlighted before, TOTAL3 has been unable to break above its November 2022 highs, failing to follow Bitcoin and Ether as they traversed the same highs earlier this year. It’s for this exact reason that we’ve previously declared that Alt Season it ain’t. Following the SEC-fueled bloodshed in alts, the REKTelligence STRETCH % indicator shows that TOTAL3 is now approximately -9.0% below the 20MA and a retest of the 2022 lows looks a near certainty. Several past lows in TOTAL3 have seen the STRETCH % reach at least -15.0%, so we could easily see more altcoin weakness ahead. We’ll continue to stick with the megacaps for now (i.e. BTC and ETH), avoiding the treacherous tide currently washing out the sh*tcoins. Stay alert out there… the altcoin tide is still receding, and filled with rip currents. [REKTelligence Report, June 12, 2023]

https://rektelligence.substack.com/i/127733552/the-altcoin-tide-is-still-receding

After months of continued altcoin downtrends and/or sideways consolidation near lows, however, we’re finally seeing price action confirm our AROC indicator signals. As we’ll illustrate next, the earliest phase of Alt Season has arrived. Alt spring has sprung.

As many know, the TOTAL3 symbol represents the total crypto market capitalization excluding both Bitcoin and Ethereum — the top two crypto assets. TOTAL3 provides a good proxy for altcoins, although USD-pegged stablecoins remain within the calculation so it’s imperfect to be sure. That said, TOTAL3 has now broken solidly above its one-year moving average (365ma) and appears to be challenging its November 2022 highs — something which Bitcoin and Ether did long ago. Even after last year’s altcoin decimation, the rolling annualized return for TOTAL3 still sits at an impressive +56%. Take that stonks.

TOTAL CRYPTO MARKET CAP (TOTAL3). Daily Chart with REKTelligence AROC Indicator.

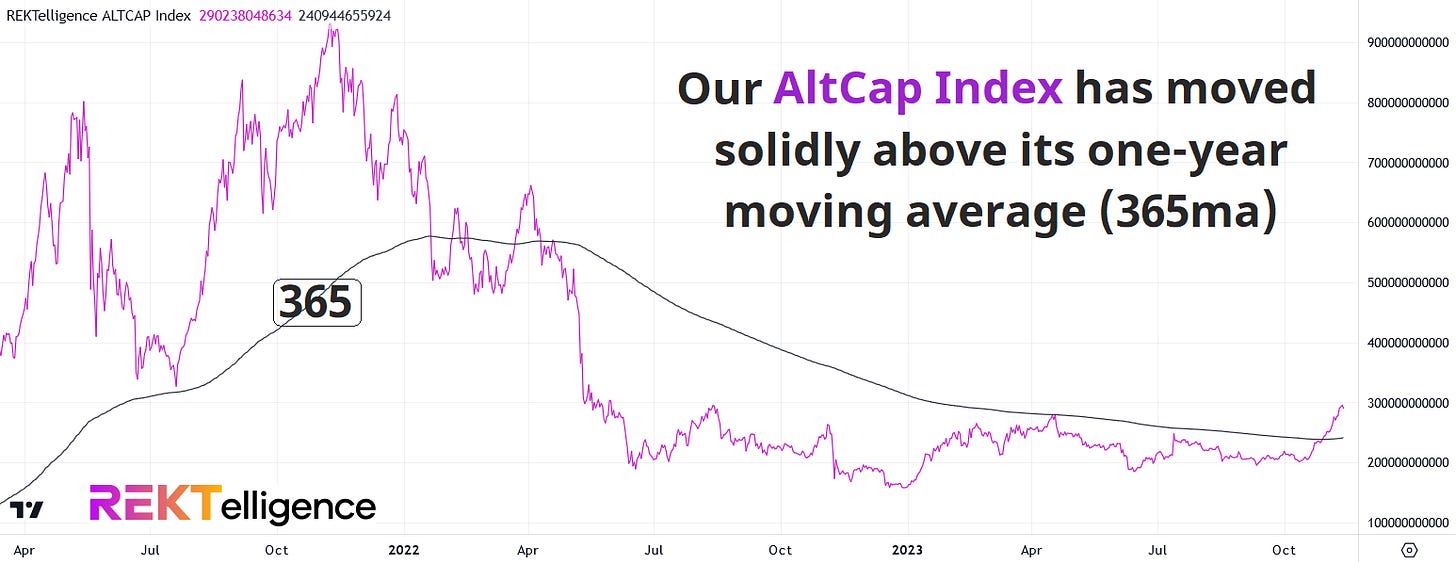

For a better gauge of Altcoin performance, the REKTelligence AltCap Index removes Bitcoin, Ether and the top four stablecoins from the calculation. Removing more stables beyond the top four makes no discernible difference.

Like TOTAL3, the AltCap Index shows a solid breakout above its 365-day exponential moving average and more importantly has now climbed above its November 2022 highs — a major positive. Ideally, to put more nails in the bear market’s coffin, we’ll soon see the the index push more convincingly above that 2022 resistance level.

REKTELLIGENCE ALTCAP INDEX. Daily Chart with 365-Day Exponential Moving Average.

While not all alts are rising, many of the higher market cap altcoins show massive improvements. For example, Solana has now convincingly cleared its prior 2023 highs, confirming the early 2023 signal when its AROC indicator moved above its own 200ma.

For those unfamiliar with the AROC from our past reports, the AROC indicator shows the rate of change of the annualized return. When the rate of change moves above its 200ma, this often indicates a positive shift in momentum for the asset. While SOL’s AROC moved above its 200ma in early 2023, we only saw price confirm this positive development recently.

SOLANA (SOL/USDT). Daily Chart with REKTelligence AROC Indicator.

Accelerating more recently, TRON’s AROC turned positive in the spring, with price improving amid volatile swings ever since.

TRON (TRX/USD). Daily Chart with REKTelligence AROC Indicator.

A similar pattern in LINK preceded its noteworthy fall breakout to the upside.

CHAINLINK (LINK/USDT). Daily Chart with REKTelligence AROC Indicator.

With clear evidence that select leading alts are now under accumulation, we believe that both time corrections and price corrections should provide relatively advantageous entries in the weeks to come.

The novice trader chases the pump with no plan for risk (dangerous and greed-based) while the veteran trader waits patiently for an optimal, lower risk entry point (rational and risk-minded). We’ll seek to identify some of these levels in the weeks to come.

For now, we’ll enjoy the early shoots of an Altcoin Spring.

peace_love_crypto-DB

IMPORTANT DISCLAIMER

The information presented and made available in this newsletter is intended for educational purposes only. THE INFORMATION IS NOT AND SHOULD NOT BE CONFUSED WITH INVESTMENT ADVICE AND DOES NOT ATTEMPT OR CLAIM TO BE A COMPLETE DESCRIPTION OF ANY SPECIFIC COINS, TOKENS OR MARKETS OF ANY KIND, BUT RATHER EDUCATIONAL EXAMPLES OF THE APPLICATION OF TECHNICAL ANALYSIS AND QUANTITATIVE ANALYSIS TO THE MARKET. This information has been presented and prepared without regard to any particular person's investment objectives, financial situation and particular needs because as individuals come from diverse backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from your investment advisor or other financial professional as appropriate before taking any action. The opinions and analyses included herein are based on sources and data believed to be reliable and are presented in good faith, however no representation or warranty, expressed or implied is made as to their completeness or accuracy. It is imperative to understand your investment risks since all stock investments involve significant risk. The user of REKTelligence’s newsletters, podcasts, courses, coaching and other educational services agrees to indemnify and hold harmless REKTelligence LLC from and against any and all liabilities, expenses (including attorney's fees), and damages arising out of claims resulting from the use of this educational content. REKTelligence LLC is not a licensed investment advisor.

© 2023 REKTelligence LLC